Analyzing Data from the Monthly Treasury Statement

Analyzing Data from the U.S. Budget Historical Tables

Analyzing Market Data with the Yahoo API

Analyzing Data from the Monthly Treasury Statement

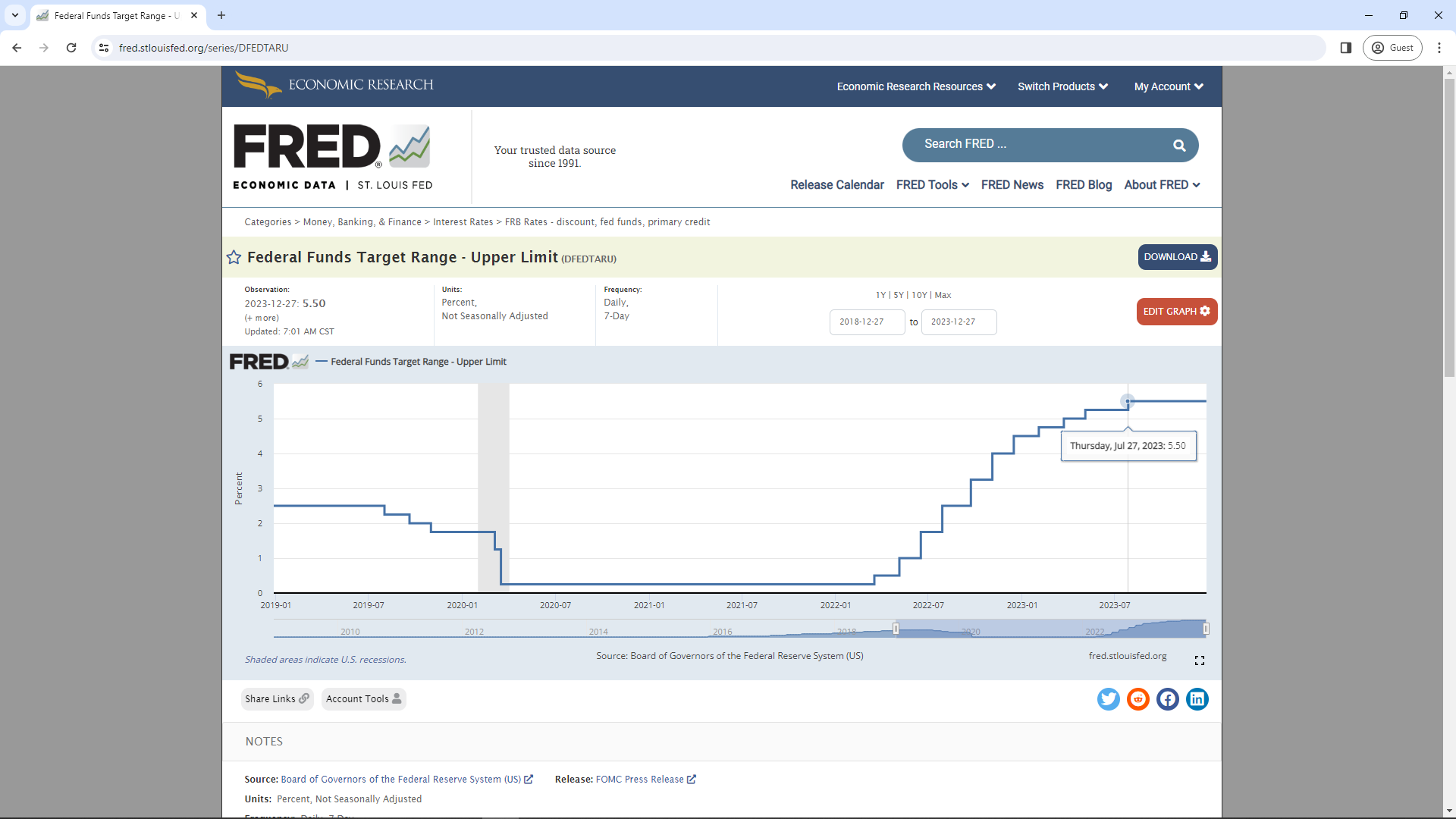

There has been much mention recently that federal interest payments are rising. This article from the end of November states "Interest payments as percent of GDP rose to 3.5% in Q3, based on today's revised nominal GDP for Q3". Further on, it states "The ratio of 3.5% was the highest since 2000, but well below the range between 1979 and 2002, when it had peaked at over 5%, and stayed above 4.5% for nearly 15 years." This can be seen in FRED (Federal Reserve Economic Data) via the following steps:

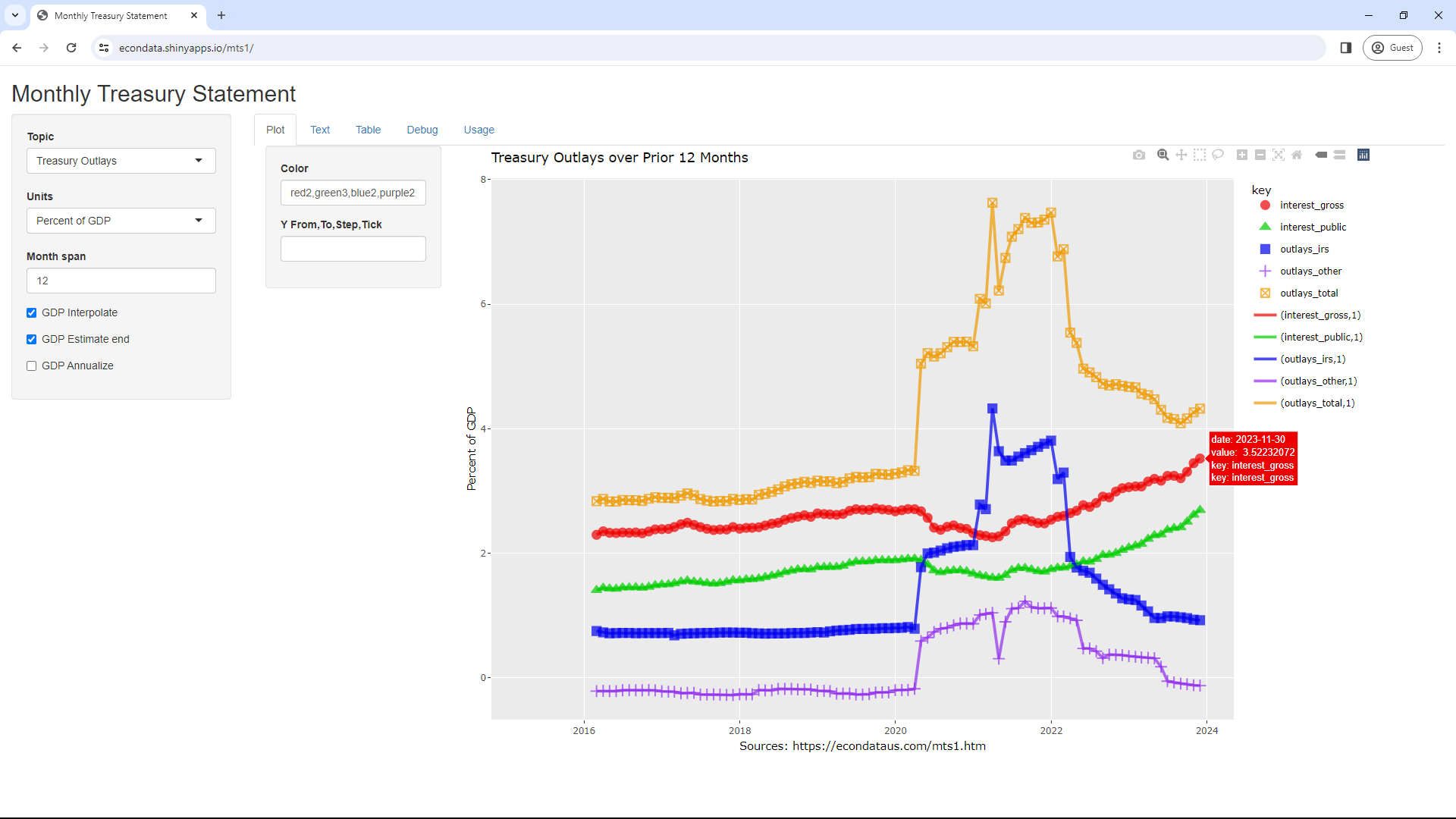

It's also possible to look at the interest payments in the Monthly Treasury Statement, the current issue of which can be found at this link. All of the values back to early 2015 can be seen by going to the R Shiny app at https://econdata.shinyapps.io/mts1/, setting Topic to "Treasury Outlays" and setting Units to "Percent of GDP". This should create the following graph:

The red line in the above graph shows a rolling sum of a consecutive 12 months of the Gross Treasury Interest as a percent of GDP. The red box at the far right of the line is created by hovering over the last point of that red line. The Gross Treasury Interest consists of Treasury interest payments on the Public Debt (the green line) plus Treasury interest payments on Special Issue treasuries held by the government, chiefly the trust funds. The source for this data is this Treasury URL. One problem though is that GDP is only reported quarterly. This program estimates monthly GDP by assigning the quarterly annualized GDP to the second of the 3 months of each quarter and then interpolating to the next second month of the next quarter to estimate the GDP of the first and third months. It does this only if "GDP interpolate" is checked. Otherwise, the quarterly GDP is used for all 3 months of each quarter. In addition, there can be a problem if the last quarter's GDP has not yet been reported. If "GDP Estimate end" is checked, this next quarter's GDP is estimated to be the last quarter's GDP plus the difference between it and the GDP of the quarter before it. If "GDP Estimate end" is not checked, however, the next quarter's GDP is assumed to be the same as the last quarter's GDP. In any event, all of the values can be seen by clicking on the Text or Table tab.

It should be noted that the red line in the above graph refers to "Interest on Treasury Debt Securities (Gross) in Table 3 of the Monthly Treasury Statement. The MTS for September 2023 lists $879.307 billion for the full fiscal year but also lists $659 billion for "Net Interest" in Figures 2 and 7. The difference between these two measures of interest are described as follows in this article:

Interest costs on the more than $33 trillion in federal debt also rose sharply, up 23% to $879 billion, a record. Net interest payments, excluding intragovernmental transfers to trust funds, rose 39% to $659 billion, also a record, according to a Treasury official.

Gross interest payments amounted to 3.28% as a share of gross domestic product, the highest since 2001, and the net share at 2.45% was the highest since 1998, the official said.

Interest rates have soared over the last year and a half as the Federal Reserve jacked up borrowing costs to slow inflation. The average interest cost on the Treasury's outstanding debt was 2.97% last fiscal year, up from 2.07% the year before.

The blue and purple lines in the above graph show outlays of the Treasury in addition to interest payments and the gold line shows the total outlays when interest is included. As can be seen, those other outlays increased sharply in April 2020, immediately after the start of the COVID epidemic. The chief components of these outlays, at least in April of 2020, can be seen by looking at the Monthly Treasury Statement for April of 2020. The outlays for the IRS can be seen on the last 2 lines of page 18 and the first 9 lines on page 19. As can be seen, the great majority of the increase is in the category of "Other" which contains the footnote of "1". This footnote on page 24 reads "Includes $217 billion for Economic Impact Payments to individuals and families". According to this link, the first round of the Economic Impact Payments was in March of 2020 and was $1,200 per income tax filer, $500 per child (CARES Act).

The purple line shows that other outlays were slightly negative from early 2015 to 2020 but likewise increased sharply in April of 2020. Looking on page 18 for those lines in which the monthly outlays are the great majority of the current fiscal year to date reveals that the main driver of the increase in other outlays was $141.912 billion for the "Coronavirus Relief Fund" though there was also $12.547 billion for "Air Carrier Worker Support" and $9.98 billion for "Exchange Stabilization Fund".

The following outlays (in percent of GDP) from March of 2020 to present can be seen by clicking the Text or Table tabs:

date interest_gross interest_public outlays_irs outlays_other outlays_total us_receipts us_outlays cpi gdp

61 2020-03-31 2.708773 1.913364 0.7889758 -0.17478797 3.322961 3558.418 4595.263 258.115 21510.78

62 2020-04-30 2.675416 1.889302 1.7776533 0.59129343 5.044362 3264.736 5199.736 256.389 21571.59

63 2020-05-31 2.570574 1.819281 1.9979530 0.64692197 5.215449 3206.532 5332.585 256.394 21621.79

64 2020-06-30 2.412597 1.724229 2.0115294 0.73673435 5.160860 3113.409 6095.059 257.797 21614.38

65 2020-07-31 2.377931 1.694145 2.0438625 0.79003217 5.211826 3425.557 6350.503 259.101 21549.35

66 2020-08-31 2.426258 1.716108 2.0806726 0.80345878 5.310390 3420.813 6345.510 259.918 21426.72

67 2020-09-30 2.448744 1.724645 2.1035195 0.84372615 5.395990 3419.954 6552.030 260.280 21343.67

68 2020-10-31 2.405653 1.727167 2.1158343 0.87174780 5.393235 3412.132 6693.810 260.388 21300.20

69 2020-11-30 2.392476 1.709101 2.1329801 0.87264528 5.398101 3406.499 6624.606 260.229 21296.31

70 2020-12-31 2.323832 1.672045 2.1310763 0.86949610 5.324404 3416.813 6765.209 260.474 21297.11

71 2021-01-31 2.292075 1.645564 2.7839899 1.01114403 6.087209 3429.176 6907.811 261.582 21302.60

72 2021-02-28 2.278741 1.629378 2.7092846 1.02580798 6.013833 3489.539 7043.762 263.014 21312.77

73 2021-03-31 2.257416 1.607490 4.3266047 1.04416061 7.628181 3520.387 7615.076 264.877 21344.38

74 2021-04-30 2.273007 1.605507 3.6390298 0.30714674 6.219183 3717.711 7300.128 267.054 21397.42

75 2021-05-31 2.354592 1.649547 3.4892729 0.89970245 6.743567 4007.595 7323.144 269.195 21471.89

76 2021-06-30 2.481573 1.729479 3.4898115 1.11187015 7.083254 4215.965 6841.601 271.696 21615.41

77 2021-07-31 2.533055 1.761767 3.5534165 1.12028522 7.206757 3914.469 6779.163 273.003 21827.97

78 2021-08-31 2.548516 1.763750 3.6081682 1.23000413 7.386688 3959.626 6794.860 273.567 22109.57

79 2021-09-30 2.515390 1.740036 3.6562550 1.13560146 7.307246 4045.980 6818.147 274.310 22357.90

80 2021-10-31 2.486390 1.712233 3.7097780 1.11713063 7.313299 4092.209 6745.361 276.589 22572.95

81 2021-11-30 2.480967 1.704423 3.7598018 1.11660717 7.357376 4153.864 6853.086 277.948 22754.73

82 2021-12-31 2.539900 1.743972 3.8092057 1.12280173 7.471907 4294.483 6871.445 278.802 22948.97

83 2022-01-31 2.586048 1.767865 3.1916209 0.98886173 6.766530 4374.911 6670.342 281.148 23155.68

84 2022-02-28 2.600708 1.770149 3.2965431 0.98687254 6.884123 4416.483 6617.581 283.716 23374.86

85 2022-03-31 2.645554 1.792682 1.9421200 0.95591329 5.543587 4464.041 6198.230 287.504 23588.44

86 2022-04-30 2.683422 1.817718 1.7715872 0.92382124 5.378830 4888.503 6088.898 289.109 23796.44

87 2022-05-31 2.773486 1.868671 1.7200108 0.47254069 4.966037 4813.751 5948.416 292.296 23998.85

88 2022-06-30 2.744920 1.864711 1.6883033 0.47152194 4.904745 4825.314 5874.659 296.311 24196.35

89 2022-07-31 2.808160 1.907351 1.5942043 0.42719590 4.829560 4832.649 5790.996 296.276 24388.92

90 2022-08-31 2.910467 1.972687 1.4947940 0.31646605 4.721728 4867.998 5875.306 296.171 24576.58

91 2022-09-30 2.898052 1.975815 1.4220295 0.37352327 4.693605 4896.197 6271.635 296.808 24761.85

92 2022-10-31 2.991602 2.002740 1.3546605 0.37006652 4.716329 4930.847 6229.026 298.012 24944.71

93 2022-11-30 3.045691 2.053008 1.2783809 0.36575003 4.689822 4901.749 6257.129 297.711 25125.19

94 2022-12-31 3.062674 2.092134 1.2599058 0.35034932 4.672929 4869.954 6289.031 296.797 25294.22

95 2023-01-31 3.074657 2.122824 1.2502616 0.33862013 4.663539 4852.163 6428.723 299.170 25451.81

96 2023-02-28 3.073462 2.150124 1.1617000 0.32818436 4.563346 4824.391 6446.795 300.840 25597.96

97 2023-03-31 3.152265 2.231290 1.0675907 0.32094274 4.540798 4822.460 6630.258 301.836 25744.96

98 2023-04-30 3.195972 2.288014 0.9619707 0.31577355 4.473717 4597.331 6537.164 303.363 25892.82

99 2023-05-31 3.165781 2.301399 0.9600285 0.17777710 4.303587 4515.825 6629.783 304.127 26041.52

100 2023-06-30 3.242807 2.375805 0.9878344 -0.05239925 4.178242 4473.381 6726.265 305.109 26182.85

101 2023-07-31 3.244436 2.404664 0.9855307 -0.07286675 4.157100 4480.206 6742.822 305.691 26316.79

102 2023-08-31 3.206233 2.416988 0.9727144 -0.09068146 4.088266 4459.610 6413.374 307.026 26443.35

103 2023-09-30 3.308953 2.506890 0.9594647 -0.10280922 4.165609 4439.360 6134.432 307.789 26573.56

104 2023-10-31 3.447203 2.618849 0.9344699 -0.11784309 4.263830 4524.217 6198.055 307.671 26707.40

105 2023-11-30 3.522321 2.693522 0.9255971 -0.12428667 4.323631 4546.936 6286.251 307.051 26844.88

The above numbers show the sharp increase in total Treasury outlays in April of 2020 and how they reached a maximum of 7.628 percent of GDP in March of 2021. Also, it should be noted that interest_public is a subset of interest_gross. Hence, outlays_total = interest_gross + outlays_irs + outlays_other.

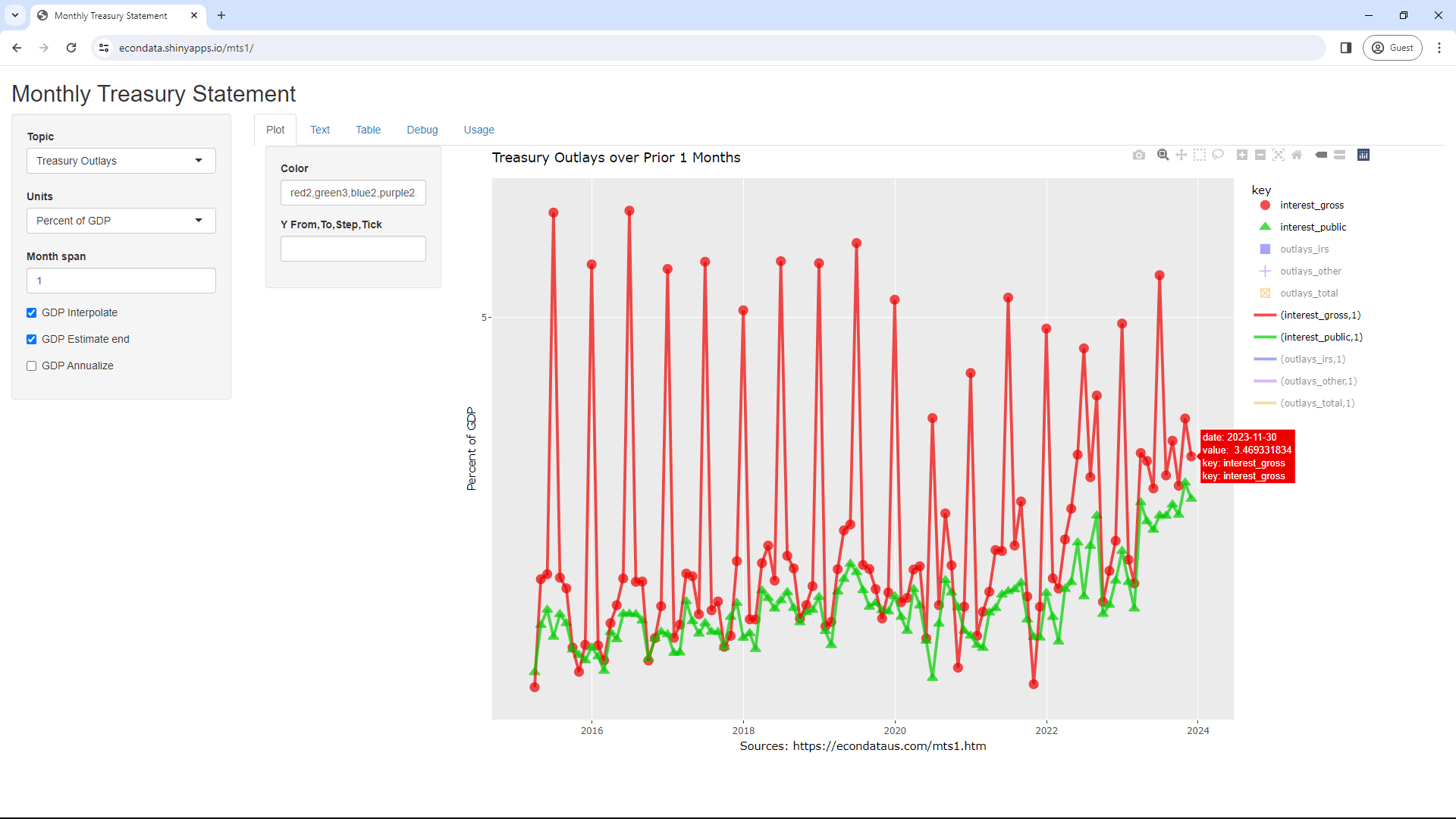

Changing "Month span" from 12 to 1, clicking on the 6 outlay legends (the blue, purple, and orange symbols and lines), and clicking on the X Autoscale control in the upper right of the graph will create the following graph:

This shows the monthly interest payments individually and show that the gross interest payments spike in June and December. This is because they include the intergovernmental transfers of interest which occur only twice per year. This is described on this page which states:

Interest on special-issue investments is paid semi-annually, at the end of June and the end of December. Because the trust funds hold no cash, investments are redeemed each month to pay for benefits and administrative expenses. When investments are redeemed, interest is paid. The amount of interest paid is used to offset the amount of investment redemptions.

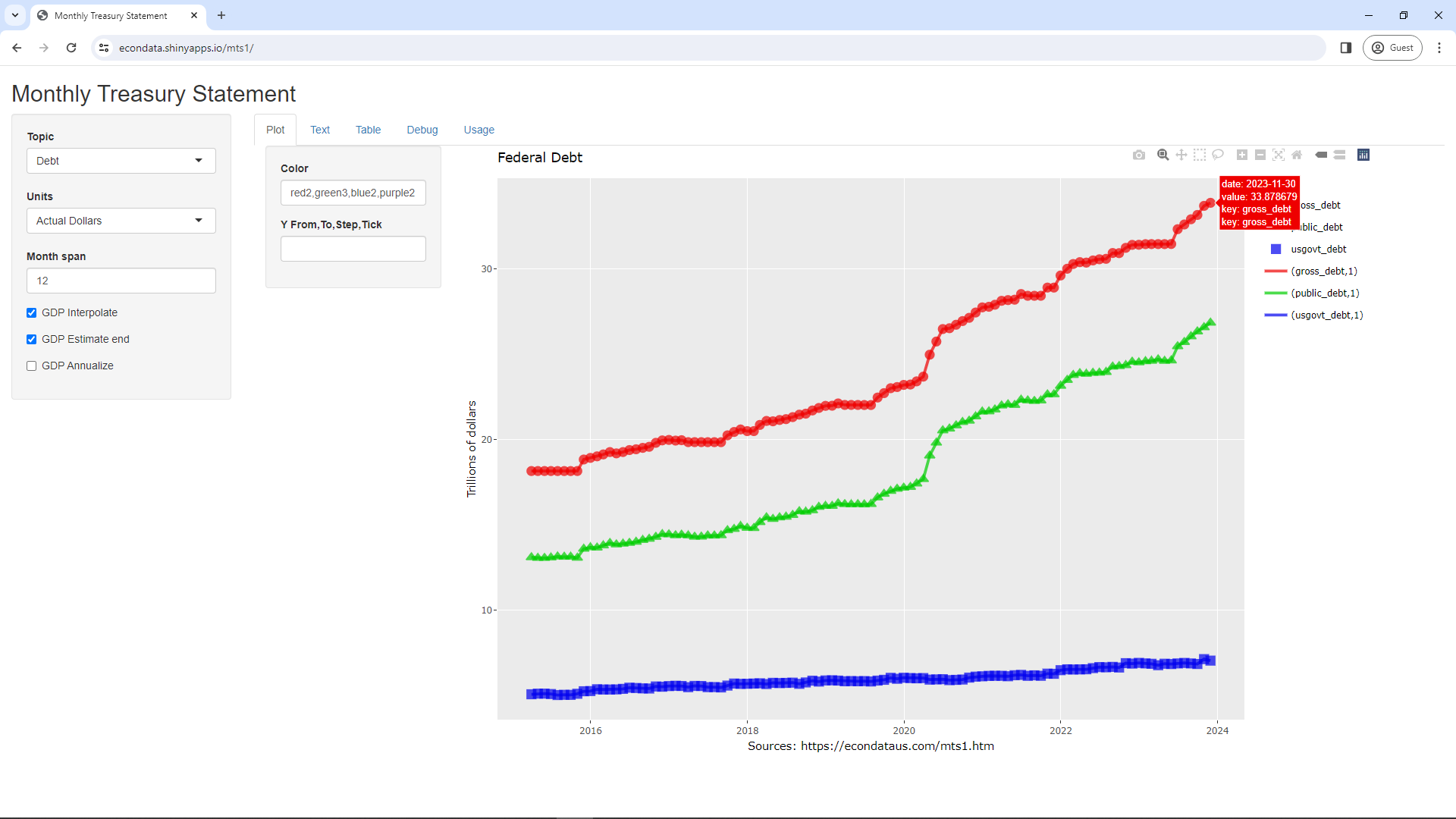

Changing Topic to "Debt", Units to "Actual Dollars", and "Month span" to 12 will create the following graph:

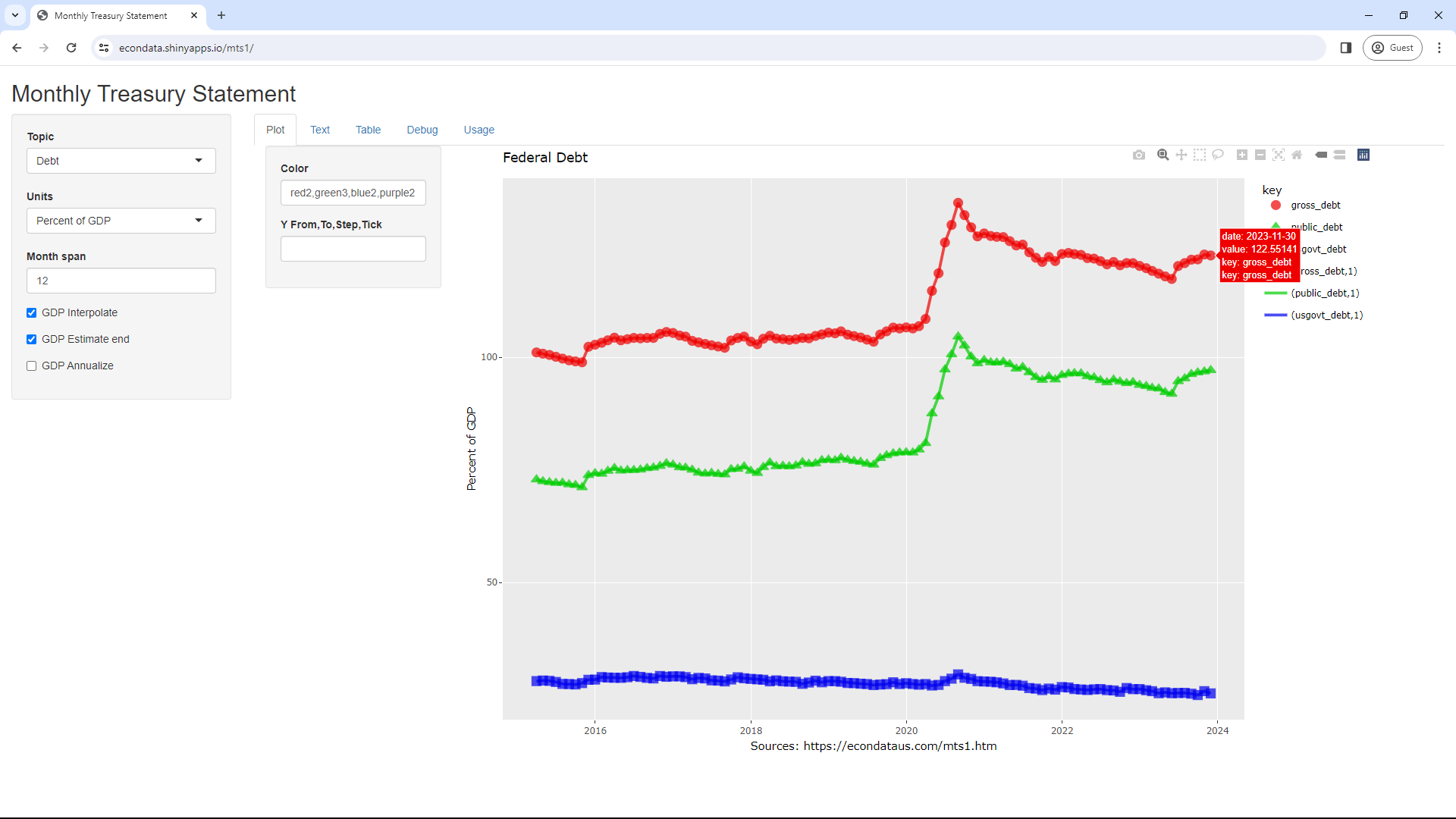

This shows that the "$33 trillion in federal debt" referred to in the prior article refers to the "Gross Debt" which included the "Public Debt" (or debt held by the public) plus intergovernmental debt held by the U.S. government. The usual way to judge the burden that this debt puts on the economy is to look at it as a percent of GDP. Changing Units to "Percent of GDP" creates the following graph:

This suggests that the burden of the extra debt from the COVID epidemic has stabilized but has done so at the higher level of just over 120% of GDP rather than the prior level of just under 100 percent of GDP.

Analyzing Data from the U.S. Budget Historical Tables

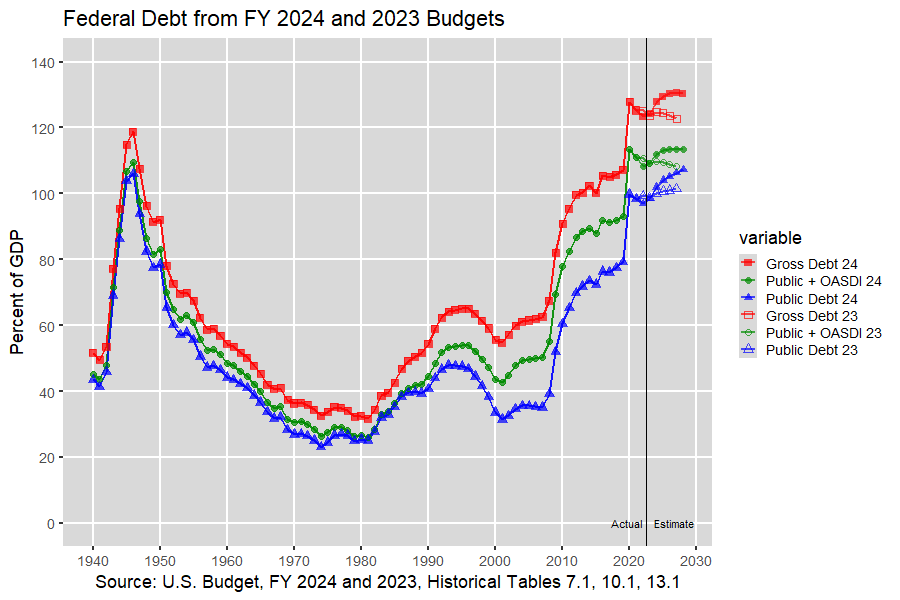

The change in the debt since 1940 can be seen by looking at the Historical Tables in the annual United States Budget. This can be done by going to the R Shiny app at https://econdata.shinyapps.io/bud1/, setting Topic to Debt and setting Units to "Percent of GDP". This should create the following graph:

In the above graph, the solid symbols to the left of the vertical line (in the "Actual" sector) are the actual historical values of the debt. The solid symbols to the right of the vertical line (in the "Estimated" sector) are the projected values from the 2024 U.S. Budget and the empty symbols are the projected values from the prior 2023 U.S. Budget. As can be seen, the projected debt has gone up since the prior budget.

Most noteworthy perhaps is that the debt has reached a level as a percent of GDP not seen since the end of World War II. Once the war ended, the gross federal debt fell to a low of 31.8 percent of GDP in 2081 but then nearly doubled to 62.4 percent of GDP by 1992 when it was raised as a major item of discussion in the 1992 Presidential election by Ross Perot. Several books came out about the danger of the debt around that time, including "Facing Up" by Peter G. Peterson and "Backruptcy 1995" by Harry E. Figgie. The above graph shows that the gross debt then declined, reaching a low of 54.8 percent of GDP in 2001. In 2001, the U.S. federal budget ran it's last unified budget surplus. In fact, a January 2001 Washington Post article reported how "Federal Reserve Chairman Alan Greenspan yesterday endorsed the idea of a major federal tax cut as not only fiscally prudent but also necessary". The fear seemed to be that if "the surpluses don't end when the debt does, there could be a serious economic disruption". Of course, the graph shows that the debt has only increased since then, most rapidly in the financial crisis of 2008 and the COVID epidemic in 2020.

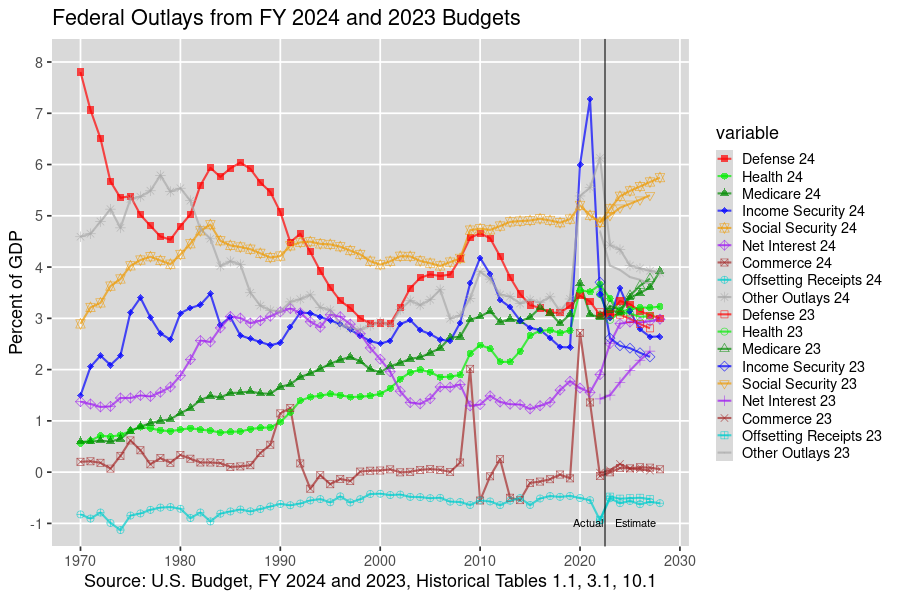

Graphs of numerous budget items can be found at this link. Following is one of the other graphs which shows the outlays for major budget functions since 1970:

The purple line shows that Net Interest peaked just above 3 percent (3.191%) of GDP in 1991 reached a low just above 1 percent (1.234%) of GDP in 2015. It rose just below 2 percent (1.904%) in 2022 and was projected to rise up to nearly 3 percent (2.9835%) of GDP in 2028 in the 2024 U.S. Budget. The 1.904% of GDP figure for 2022 is very nearly equal to the 1.907% of GDP figure for 2022-07-31 outlays of interest_public in the table above. This is represented by the green line in the graph preceding that table and represents only that interest paid to the public, excluding intergovernmental interest paid by the federal government to the trust funds.

Also noticable in the graph above is that Commerce outlays spiked in 1975, 1991, 2009, and 2020. Those years marked the end of recessions and the high spikes in 1991, 2009, and 2020 were likely related to expenditures to deal with the Savings and Loans Crisis, the Financial Crisis, and the COVID epidemic. 2009 and 2020 were also followed by spikes in Income Security outlays in 2010 and 2021. Also noticable in the steady increase in Medicare and Health (which includes Medicaid) outlays since 1970. Social Security outlays were fairly steady through 2008 but have been rising since then. Finally, "Other Outlays" was fairly stable as a percentage of GDP from 1990 to 2019 but spiked in 2020 through 2022. Other graphs at this link suggest that this spike was chiefly due to increased outlays in Education and General Government.

Clicking on the related links at the link labeled "Top Outlays, 1970-2028" will bring up the above graph followed by a table which contains the numbers mentioned in the paragraph that follows the above graph.

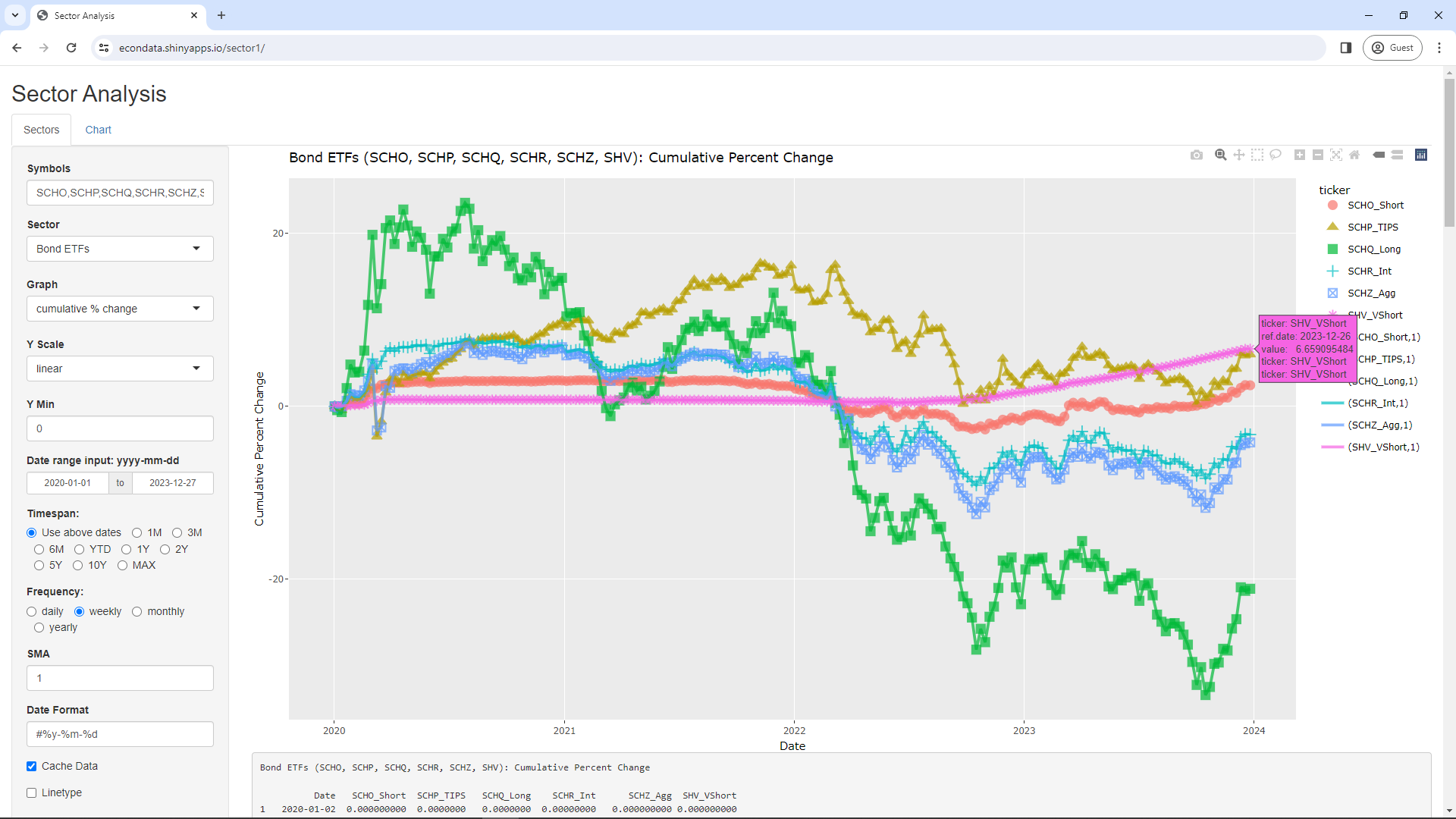

Analyzing Market Data with the Yahoo API

The recent rise in the interest rates paid by bonds has had a marked effect on their value. This is discussed at this page. As noted, a graph showing the change in value of several bond ETFs can be examined via the following steps:

Following is a further discussion of this graph from https://econdataus.com/sector1.htm:

As can be seen, nearly all of the Bond ETFs fell from the end of 2021 through the end of 2022. The one exception was SHV which, according to this link, had an ultrashort duration of about 0.27 years. This January 7, 2023 article starts with the following key points:

Regarding 2023, the article did go on to state:

The Federal Reserve is poised to continue raising interest rates, but the increase is unlikely to be as dramatic or rapid - in which case the impact on bonds would be more muted, advisors said.

As the bond ETFs graph shows, the value of long-term bonds did drop futher in 2023 but the drop was more muted as the article suggested. Since about October 19, 2023, the value of bonds have been rising.

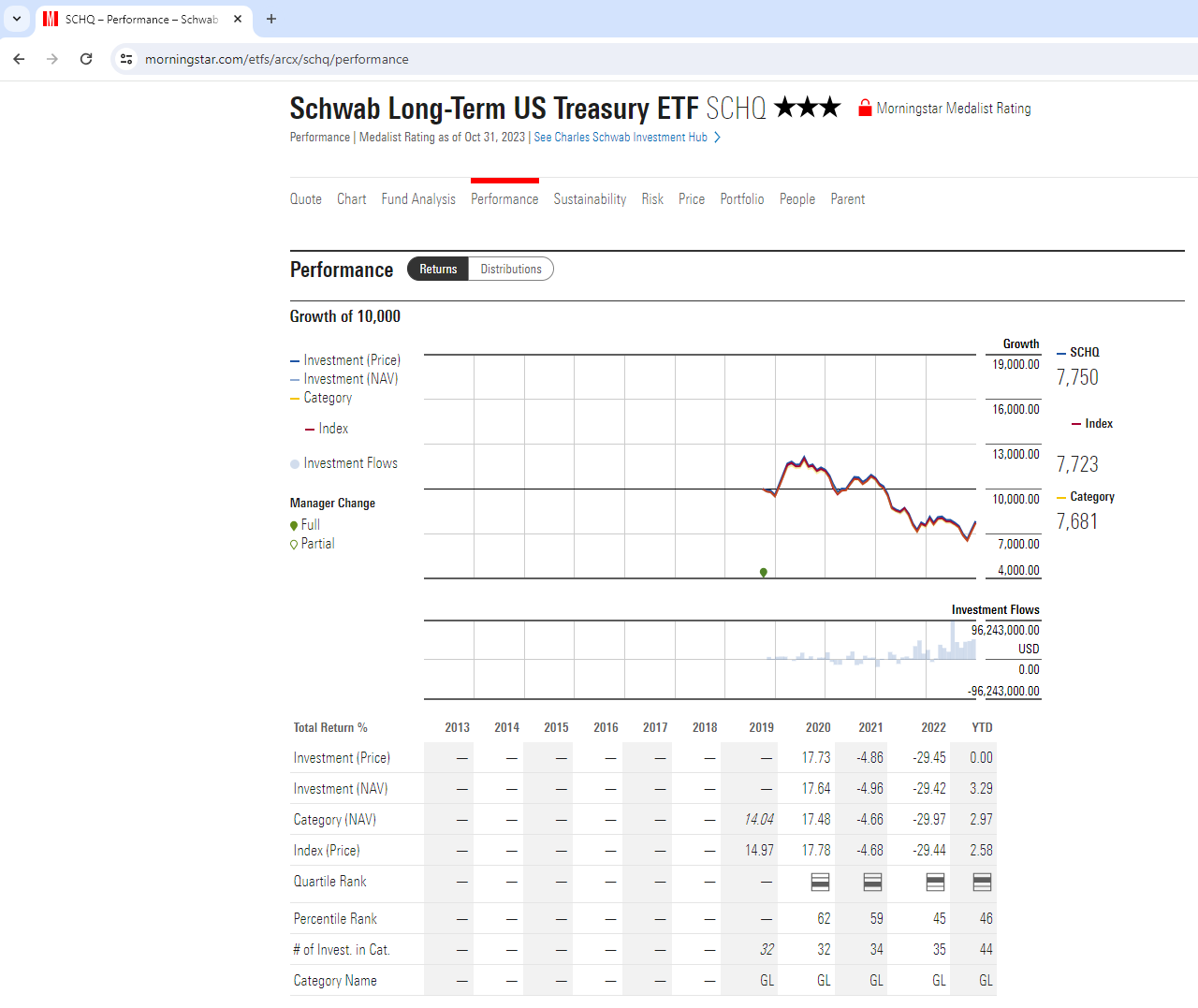

The sector graphs look at the adjusted prices which should adjust them for any dividends or splits. Still, it's possible to verify the graphs by looking at the results on Morningstar via the following steps:

This should display the following graph:

As can be seen, the above graph is similar to the green line for SCHQ in the Bond ETFs graph above.